🏠Mortgage Calculator

Built with Python. Powered by logic. Designed for real-world decisions.

⚡ TL;DR

This isn’t your bank’s calculator.

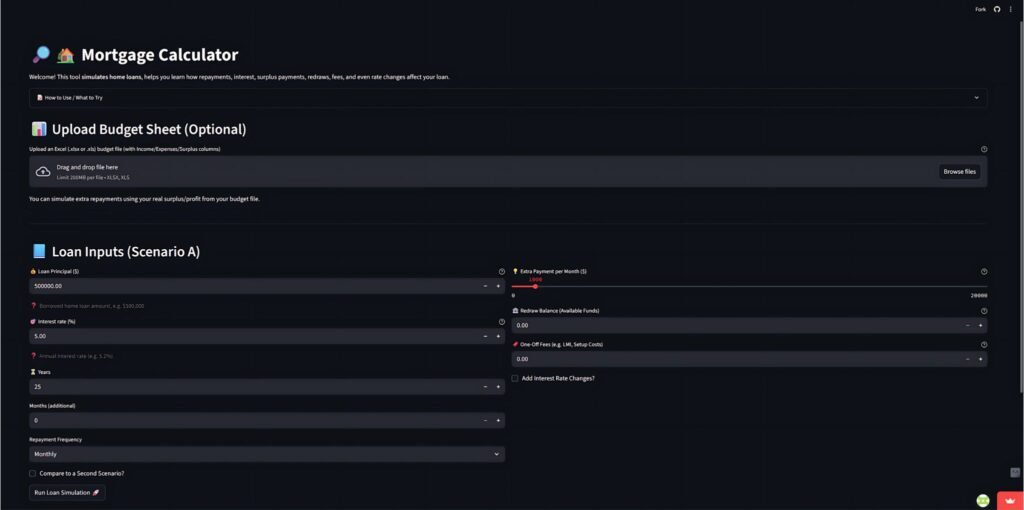

It’s a high-powered, real-world mortgage tool that lets you:

✅ Slash years off your loan

✅ Model redraws, fees, and interest rate shocks

✅ Compare strategies side-by-side

✅ Download the data – no fluff, no guesswork

All built with Python + Streamlit.

All live. All free.

⚔️ Why I Built It

Let’s be real.

Most mortgage calculators are either:

🦴 Bare-bones relics

🧠 Overly complex spreadsheets

🪤 Lead traps for lenders

I wanted something better.

So I built a calculator that actually thinks like a real borrower – not a bank robot.

🔧 Features That Actually Help

| 💡 Feature | 💥 Why It Matters |

|---|---|

| Extra Repayments | Shave years off your loan without lifting heavy 💰 |

| Redraw Balances | Model flexibility in real-life situations |

| Rate-Rise Stress Tests | See if your plan survives the bank’s next surprise 🔥 |

| Scenario Battles | Compare 2+ plans side-by-side – no guesswork |

| Interactive Charts | Get clarity in real time – no spreadsheets required |

| Download Results | Take it with you, share with advisors, or brag to your bank |

🛠️ From Python to Powerhouse

It started as a dusty little console app.

Now it’s a full-blown financial weapon built with:

Python • Streamlit • Pandas • Plotly • openpyxl

📈 What started as a “can I build this?”

became

“Why doesn’t this exist already?”

🌍 Built to Be Used

Not Just Shown Off

You don’t need to install anything.

You don’t need to sign up.

You just click – and go.

▶️ Launch the app.

👀 Watch the charts respond.

📊 Download the results.

💥 Decide with confidence.

🔗 Try It Now

“Your mortgage has met its match.”

🔮 What’s Next

I’m not stopping at graphs and sliders.

I’m building the future of mortgage advice – and it talks back

🤖 Introducing: HomePay AI

Your digital mortgage coach.

No jargon. No sales pitch. Just real answers, powered by AI.

Built on top of my calculator, HomePay AI uses GPT-style intelligence to turn your raw numbers and budget spreadsheets into clear, strategic advice.

💬 Ask it things like:

“How much faster could I repay if I add $100/week?”

“Should I switch to fortnightly repayments?”

“What’s the breakeven point for refinancing?”

It reads your budget.

It checks your loan.

Then it gives you plain-English advice – no bank lingo, no upsells.

💡 Why It Matters

Because mortgage stress is real.

And most people aren’t financial analysts.

HomePay AI turns confusing data into confident decisions.

It’s like having a mortgage coach in your pocket

Except it doesn’t charge 2% interest or sell you insurance.

🛠️ Under the Hood

This project showcases:

📐 UX that makes “serious” software feel effortless

🧠 Applied AI using LLMs (like GPT)

📄 Custom budget upload & parsing (Excel + Pandas)

🧾 Real-time response generation

🏗️ Intelligent prompts for complex financial logic

🚀 What This Shows Employers

I can design and deploy end-to-end tools

I use AI for real-world problem solving

I translate complex logic into user-friendly products

I understand how to build trustworthy experiences with sensitive data

🔗 HomePay AI Coming Soon

“What if your mortgage tool actually told you what to do next?”

Until then…

Disclaimer: These apps do not provide financial advice.

These tools (HomePay AI & Mortgage Calculator) are for informational and educational use only.

For personalised mortgage advice, please consult a licensed financial adviser.